Be a smart investor

Born and brought up in a humble family, Mr. C.M. Purohit came to Mumbai – the city of dreams to fulfil his dreams. One among the five siblings whose father was a head post master, he decided to script his destiny.

“I left Konkan and came to Mumbai in 1987. I was 25 then. I always wanted to do something of my own. So, I started an education coaching class – Yashodeep, in Bhiwandi. I received an overwhelming response. I appointed three teachers and had 150 students. While the coaching class was doing well, I wanted something bigger.”

CM Purohit switched from the education sector to insurance. He was awarded the prestigious honour MDRT (Million Dollar Round table) 11 times while he worked in the Insurance sector.

“I shifted to Thane in 2004. I surrendered to my insurance agency and started working as a financial planner. While working in the financial market, I observed many malpractices in finance. I was taken aback and wanted to do something for the betterment of society (win-win situation for investors). I started educating people about the financial products and offered them only a ‘need-based’ service. I have always believed in the ‘pull’ factor rather than in ‘push’.

Like any other business, CM Purohit went through his share of challenges. However, he overcame them with his sheer hard work and determination. He says, “I had no contacts initially, but UTI helped me. Every day I met around 10-12 people. I sought their appointments and had conversations about their financial goals. I understood their needs and pitched the best financial plans for them that would help them realise their financial dreams.”

Besides meeting people, CM Purohit conducted regular seminars on financial planning. His seminars focused on market trends and investment insights and not on any particular financial product. Gradually his client base expanded through word-of-mouth publicity.

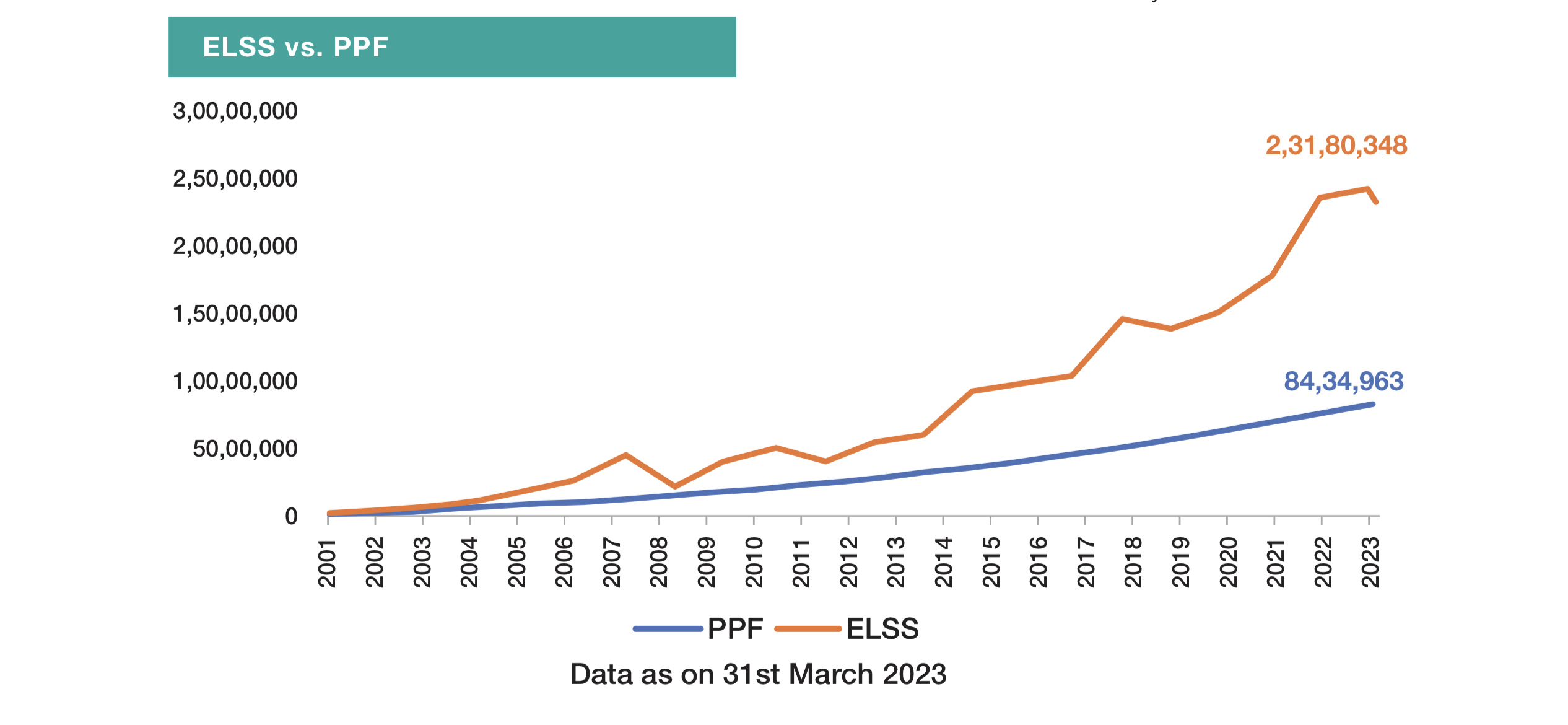

CM Purohit offers different investment avenues to its clients. It includes mutual funds, PPF, direct equity and bonds, to name a few. He emphasises, “Investment in mutual funds is very safe. You can see your portfolio valuation daily. If we compare mutual funds and PPF, returns on the former are usually 5 times more than the latter over a long-term horizon. (subject to market risk).

Investing in tax saving products is better as you get a good maturity amount and withdrawal time is less than PPF.

CM Purohit shares a case here. He says, “A woman working in the IT sector approached us. She told us that she could not have sizable savings despite many years of service. Through our conversation, I understood that it was because she had invested in a second home. Besides, she wanted to buy 2 BHK in Thane. Instead, I advised her that she stays on rent and starts investing systematically through SIP and gradually builds a healthy portfolio to buy a home. Today, she has bought a house and has enough savings.”

Often in the world of financial planning, many people tend to confuse insurance as an investment product. However, CM Purohit clears this misconception. He avers, “There is a difference between investment and insurance. You should avoid treating insurance as an investment product. Do not expect your insurance to give you returns. Understand the different types of insurance and choose the plan according to your needs. At the end of the day, the role of insurance is to offer protection and not returns.”

A person’s portfolio should include investment options and insurance products. CM Purohit elucidates, “Understanding the goals, needs and desires of investors and tailoring a financial plan is important. There is nothing like a perfect portfolio. One size doesn’t fit all in financial planning. Your financial plan depends on your income, investment duration and risk appetite to achieve your goal. Your portfolio should be diversified. Do not put all your eggs in one basket. Have enough liquidity. For instance, if you urgently need ₹2 lakhs and all your investment is parked in real estate, you may have a tough time liquidating it. Instead, have a proper mix of liquid options like mutual funds and relatively illiquid options like real estate in your portfolio.”

“While investing, you can apply five things ,” says CM Purohit – safety, liquidity, rate of return, tax implication and after-sale service. Moreover, use rationale instead of emotions while investing. The investment style can differ for a business person and a salaried employee. CM Purohit states, “We meet businessmen once in six months and take decisions on their investments as per their current business scenario and future business conditions. We generally suggest lumpsum investment to business class. On the other hand, we advise salaried people to invest systematically (SIPs) as they are assured of a fixed monthly income.”

The power of compounding plays a pivotal part in investing. For instance, if you invest ₹1000 per month from the age of 25 to 60, you can end up having ₹1 crore. CM Purohit says, “I advise youngsters to invest like I would ask my children to do. Besides, I feel that it is better to stay on rent than buy a house for people who are just starting out with their careers. Instead of paying EMI, it is better to do a SIP as it eventually helps to buy a house and have substantial money as a surplus.”

Purohit associates LLP the largest wealth managers in Thane and have influenced more than 50 people to date to become financial planners. Over the last 20 years, they have helped 3000 families realise their financial dreams. CM Purohit concludes, “My ultimate goal is that all my customers should be wealthy and my dream is to see my company working as a support system for every investor.”

Purohit associates LLP are the largest wealth managers of Thane managing total funds of worth Rs 850 crores.

—————————————————————————————————————————————-

Purohit Associates LLP : Ground floor, Lavina society, Chhatrapati Sambhaji road, behind school number 19, Vishnu Nagar Naupada, Thane West -400602